Vranch House is a centre for the treatment of over 2,000 outpatients with physical difficulties, a provider of various therapies throughout Devon and an independent Day School in Exeter for children with significant physical difficulties.

Find out more...Last updated: 26/07/2024

Chief Executive's Report 2017

Financial Information abstracted from the Audited Accounts for the year ending 31 March 2017

The figures used in this article are taken from the Auditor's Report for the 2016 - 2017 Financial Year. The headline financial news is included in the report of the Directors and Trustees but the following financial information is worth high lighting:

- Income increased by £165,278 from £1,743,047 to £1,908,325 but Debtors and Pre-Payments decreased by £46,419 from £74,363 to £27,944 simply because of the absence of capital project pre-payments for the new Hydrotherapy Pool. These trends are not significant.

- Net Current Assets increased by £14,235 from £1,245,166 to £1,259,401 largely as a result of capital investment in the new pool building but Total Net Funds increased by £241,936 from £6,056,466 to £6,298,402.

- Fixed Assets increased despite depreciation by £227,701 from £4,811,300 to £5,039,001. Depreciation remains a greater sum than hitherto as a resut of the highly commendable development of the asset value of the charity arising from the purchase of the Vranch House site, the construction of the new Specialist Children's Assessment Centre and the re-building of the Hydrotherapy Pool.

- With Depreciation of £137,886 carried as a non-monetary expense the charity made an operating surplus of £241,936 but with Depreciation discounted a net cash surplus of £379,980 was generated (£196,891 last year).

- It is a commendable reflection of internal fiscal controls that total expended resources decreased in the year under audit by £19,072.

- We have maintained the high number of pupils in the school and outpatients seen by the clinic whilst continuing investment in the buildings at Vranch House and in the services hosted by it.

The Trustees agreed a programme of capital investments for the Financial Year which provided for continuing maintenance of the Vranch House estate (mostly for rebuilding interior rooms at Vranch House) and for further investment in the Hydrotherapy Pool and the New Honeylands building.

Profit & Loss Account

ELEMENT | 2017 | 2016 | 2015 |

|

|

| |

Gross Income | £1,908,325.00 | £1,743,047 | £1,630,594.00 |

Gross Expenditure | £1,743,047.00 | £1,685,461 | £1,699,560.00 |

|

|

|

|

Cash Gain/Loss for the Year | £165,278.00 | £57,586.00 | -£68,966.00 |

gain/loss less Depreciation | £379,980.00 | £196,891.00 | £55,488.00 |

Summary of Key Financial Ratios:

|

|

|

|

Debtors as a Percentage of: | 2017 | 2016 | 2015 |

Total Funds | 0.44% | 1.22% | 0.53% |

Creditors as a Percentage of: |

|

|

|

Current Assets | 4.00% | 10.45% | 5.00% |

As a Percentage of Total Funds |

|

|

|

Profit/Loss for the Year | 6.00% | 3.25% | 0.90% |

Revenue Costs | 26.45% | 28% | 28.30% |

|

|

|

|

1 Profit is shown net of depreciation.

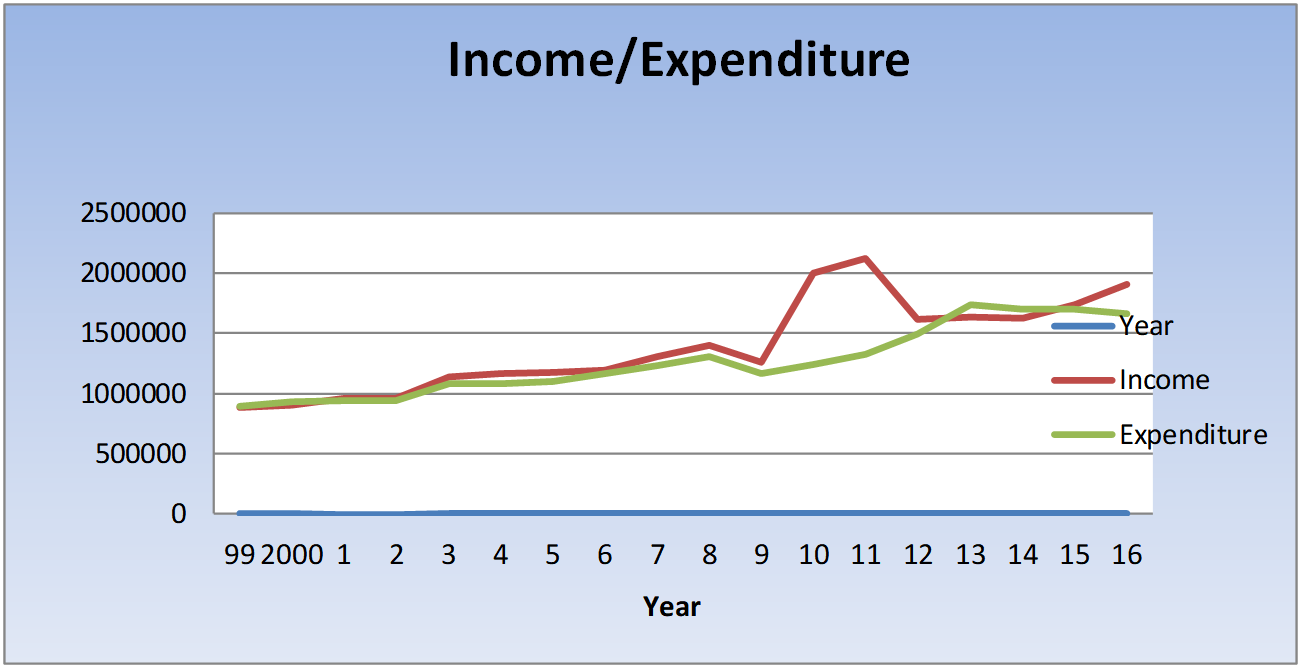

Income & Expenditure Trend

Notes:

1. Expenditure is unadjusted and includes the non-monetary expenditure of depreciation.

2. The Auditor's Report for 2016/17 is available on request at a cost of £2.00 per copy but may be viewed at no cost but by prior arrangement at Vranch House or on the Charity Commission website at www.charitycommission.gov.uk.

Future Plans

The charity's strategic objective for the next five years is to embody and develop the contract partnership with Devon County Council and the NHS North, East & West Devon Clinical Commissioning Group. The immediate objective is to continue to demonstrate performance compliance with the requirements of the joint contract and to continue to fund service objectives so that all the benchmarks are exceeded (as they were in 2017). In the longer term, the Charity aims to continue development of its services, continue the investment programme by further developing charitable income and work with its partners to respond to financial retrenchment by adaptive working practises. Our long established financial policy of holding reserves amounting to no less than a year's operating costs has proved its worth on many occasions. Given the uncertainty and instability of the financial markets and the continued imperative of national fiscal discipline we intend to maintain and further develop this reserve. The policy of not charging capital costs in any of our contracts forms the basis of our charitable benefit by contributing significantly to the 59% of the costs of the statutory services we provide. It should be noted that our statutory partners have frozen our funding at 2008 levels; that in 2018 we are embarking on what will be a tenth year without any provision for inflation. This inevitably means that the level of contribution this charity makes to statutory services must increase or the high standard of the services we provide to the Public on behalf of the State will suffer. It is, however, highly unlikely that this can continue and work is in hand to redress the imbalance. The Trustees, having authorised a £90k investment to continue the programme of buildings and equipment development and maintenance in 2018.

Colonel Graeme Wheeler

Chief Executive